Is CanWealth Legit? Full Analysis for Canadian Investors

If you’re considering investing with CanWealth, the answer is clear: proceed with caution. This investment platform does offer appealing features, but a thorough examination reveals some potential risks that every Canadian investor should understand.

The first point to evaluate is CanWealth’s regulatory standing. It operates under the supervision of provincial securities commissions, which adds a layer of protection for investors. However, it’s crucial to research the specific regulations in your province to ensure compliance and protection that fits your needs.

Another factor to consider is the platform’s transparency regarding fees and performance. CanWealth provides a clear breakdown of its fee structure, helping investors make informed decisions. Yet, remember to compare these fees against other investment options available to you, as costs can significantly impact returns over time.

Customer reviews play a vital role in gauging the reliability of any investment service. CanWealth has received mixed feedback from users. While some report satisfying experiences and positive outcomes, others express concerns about customer support and fulfillment of promised returns. Checking these reviews can provide insights into what you might expect.

Finally, think about your investment goals and risk tolerance. CanWealth may suit those looking for diversified options, but the platform’s performance may not align with every investor’s expectations. Consider speaking with a financial advisor to determine if this platform meets your strategic financial objectives.

CanWealth Review: Is It a Safe Investment for Canadians?

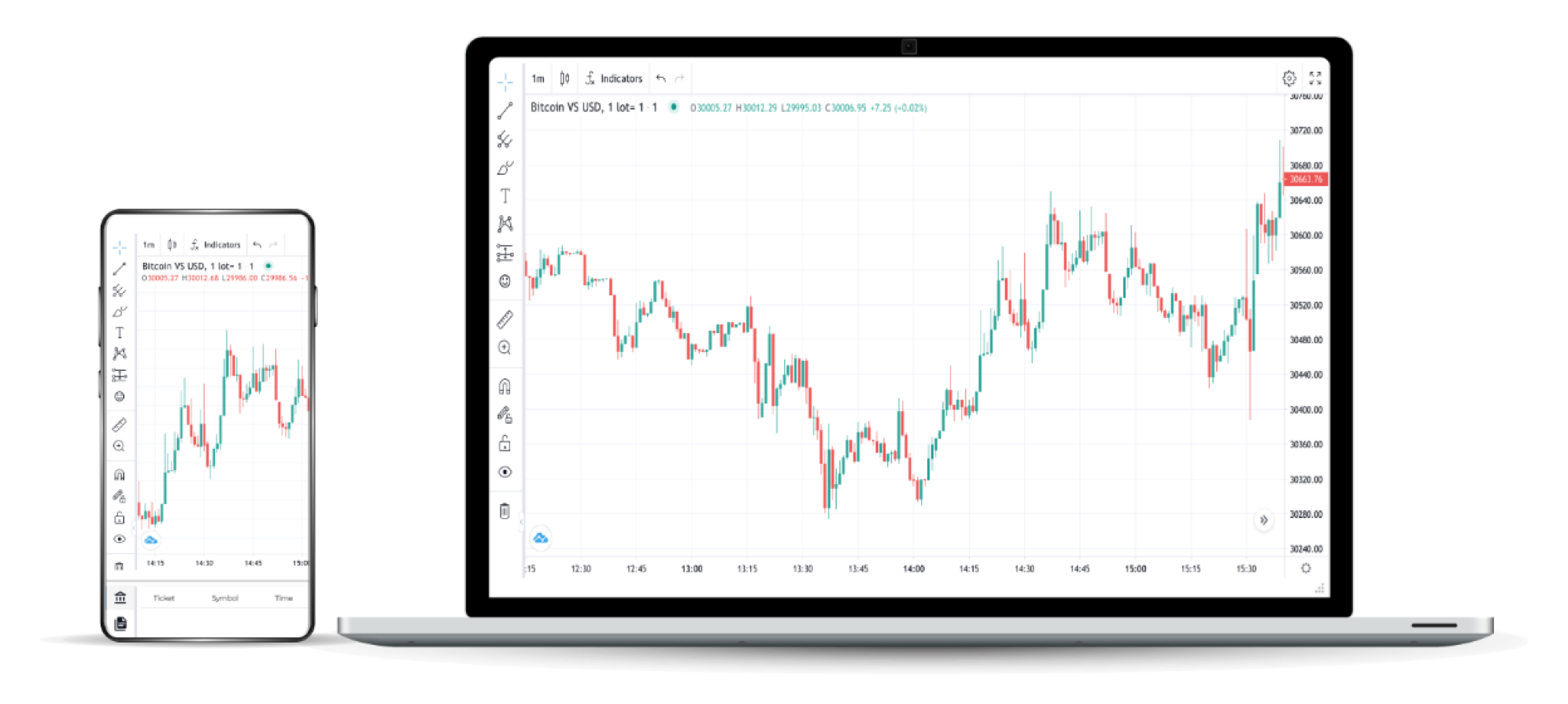

CanWealth offers Canadians a streamlined investment platform with a focus on low fees and user-friendly design. This combination creates an appealing option for both novice and seasoned investors looking for accessibility and transparency.

Security is paramount. CanWealth employs advanced encryption technologies to protect client information and transactions. Investors can have confidence knowing their data remains safe. Additionally, the platform is registered with relevant financial authorities, ensuring compliance with regulations that promote safety and trustworthiness.

Investment Options

CanWealth features a range of investment options, including exchange-traded funds (ETFs) and managed portfolios. By selecting ETFs, investors enjoy diversification without excessive costs, enhancing the potential for stable returns. Managed portfolios are tailored to fit individual risk profiles, adding a personal touch for those who prefer a more hands-off approach.

User Experience

The mobile-friendly interface simplifies account management, making it easy for users to track investments and performance. Customer support is readily available, providing assistance for any inquiries or issues that may arise, which contributes to a supportive investment experience.

In conclusion, CanWealth stands out as a viable investment option for Canadians seeking a secure and accessible platform. With a commitment to safety and a variety of investment strategies, it presents a strong case for those ready to grow their wealth. Make informed decisions and consider how CanWealth fits your investment goals.

Understanding CanWealth’s Investment Strategies and Risks

CanWealth specializes in diversified investment portfolios tailored for Canadian investors. The firm primarily focuses on a mix of stocks, bonds, and alternative assets. Each portfolio is designed according to individual risk tolerance, investment goals, and market conditions.

The investment strategy emphasizes long-term growth through a well-researched selection of quality equities. CanWealth utilizes both technical and fundamental analysis to identify undervalued stocks that exhibit solid growth potential. Regular portfolio rebalancing ensures alignment with market changes, optimizing performance.

Assessing Risks

Investing with CanWealth presents several risks. Market volatility can affect returns, especially for stock-heavy portfolios. Economic downturns may lead to declines in asset values. It’s vital to monitor economic indicators and adjust investment strategies accordingly. Mastering risk management involves setting realistic expectations about potential losses during fluctuating market conditions.

Additionally, the firm invests in alternative assets, which can introduce unique risks, including liquidity and credit risks. Investors should be aware of these factors and ensure they understand the underlying assets in their portfolio.

Key Recommendations

Regularly review your investment strategy to adapt to changing personal circumstances or market conditions. Engage with CanWealth advisors to ensure your financial objectives align with your portfolio. Stay informed about market trends and economic forecasts, as they can impact investment performance. By actively participating in your investment journey, you can better navigate the complexities of wealth management.

Evaluating User Experiences and Regulatory Compliance in Canada

Canadians interested in CanWealth should closely examine user experiences alongside regulatory compliance. Feedback from users provides valuable insights into the platform’s reliability and performance. Many report a user-friendly interface and responsive customer support. This indicates a commitment to maintaining customer satisfaction, which is pivotal for any investment service.

It’s important to check if CanWealth adheres to Canadian financial regulations. Compliance with regulations ensures that the platform operates within legal boundaries, protecting users’ interests. Verify that it is registered with the appropriate regulatory bodies such as the Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC). This affiliation should reassure potential investors regarding the safety and legitimacy of their investments.

Additional diligence involves researching user testimonials and ratings on independent review platforms. Such reviews can highlight both positive experiences and potential red flags. Consider engaging in forums or social media groups dedicated to CanWealth discussions to gather diverse perspectives from existing users.

For further information, visit the official site of canwealth group. This resource offers comprehensive details on services, user support, and compliance measures, aiding in effective decision-making for Canadian investors.

Q&A:

Is CanWealth a legitimate investment platform for Canadians?

Yes, CanWealth is recognized as a legitimate investment platform for Canadians. It operates under regulatory guidelines set by Canadian financial authorities. Users have reported positive experiences, including transparent fee structures and supportive customer service, which are good indicators of a reputable investment service.

What kinds of investment options are available on CanWealth?

CanWealth offers a variety of investment options, including mutual funds, ETFs, and specific asset management services. The platform caters to different risk appetites and investment goals, allowing users to create diversified portfolios tailored to their financial objectives.

How does CanWealth ensure the security of my personal and financial information?

CanWealth employs various security measures to protect user data, including encryption technology and secure access protocols. The platform also adheres to Canadian privacy laws, which mandate strict handling of personal financial information. Regular audits and updates help to maintain a robust security framework.

Are there any fees associated with using CanWealth?

Yes, CanWealth does charge fees, which can vary depending on the type of investment service chosen. These fees may include management fees, transaction fees, and service charges. It’s important for users to review the fee schedule provided by CanWealth to understand the costs associated with their investments.

What should I consider before investing with CanWealth?

Before investing with CanWealth, consider factors such as your investment goals, risk tolerance, and the fees associated with different investment options. It’s also wise to research the platform’s performance history and read user reviews. Consulting with a financial advisor can provide personalized insights based on your financial situation and objectives.

Is CanWealth a reliable investment option for Canadians?

CanWealth has gained attention as a potential investment platform for Canadians, but its reliability largely depends on individual investor needs and risk tolerance. The platform offers various investment products and services, which may appeal to some users, but it’s crucial to conduct thorough research and consider personal financial goals before deciding to invest. Additionally, looking into user reviews and the company’s regulatory standing can provide insights into its trustworthiness.

Reviews

MysticDaisy

I miss the days of easier choices and trust in investments.

QuickSilver

The safety of investments through CanWealth raises several pertinent aspects. First, considering regulatory compliance, Canadian financial institutions adhere to stringent guidelines, which adds a level of assurance for investors. It is also crucial to assess the platform’s reputation and customer reviews. A thorough investigation reveals mixed opinions; while some users praise the ease of use and customer service, others express concerns regarding slow withdrawal processes. Furthermore, diversification options presented by CanWealth play a significant role, as a well-balanced portfolio can mitigate risks. Lastly, investors should conduct their own research and possibly consult financial advisors before committing funds, as individual risk tolerance varies widely among Canadians.

Christopher Jones

If you’re trusting a platform with your money, make sure their name doesn’t sound like a cheap knockoff of a superhero. Just saying.

LunaStar

Why should anyone believe that CanWealth is a safe investment for Canadians when so many platforms promise security yet often lead to disappointment? Are we truly willing to ignore the litany of failed ventures that were once declared reliable? What guarantees do we have that this won’t become just another tale of lost hopes and broken trust? With economic uncertainty lurking around every corner, is it wise to invest in something that could easily fall apart, leaving us with nothing but empty promises?

Sophie Smith

I appreciate the effort behind this review, but caution is necessary. While the platform may seem appealing, it’s crucial to thoroughly investigate its security measures and customer feedback. Personal experiences can vary significantly, so relying solely on positive reviews without external sources could lead to regret. Safety and transparency should be the primary focus. Always prioritize research before parting with your hard-earned money. Confidence in investment choices is key to financial stability. Trust your instincts and seek diversified options for the best outcomes. Let’s make informed decisions that align with our goals; after all, every investment should bring peace of mind.

SweetRose

Are you seriously suggesting this is a safe bet for Canadians? What are the actual risks you’re ignoring while writing this?

Sophie

Is CanWealth your ticket to the money train, or just another ride on the budget merry-go-round? If someone tells you wealth is just a click away, grab your wallet and run! Nothing screams “trust me” like a company with a name that sounds like a 90s video game. So, Canadians, make sure your profits aren’t like snow in July: here today, gone tomorrow. Invest wisely, or you may end up with a portfolio as empty as my fridge on a Sunday!