Blazepeak Reaction Finance – Managing Investments Efficiently

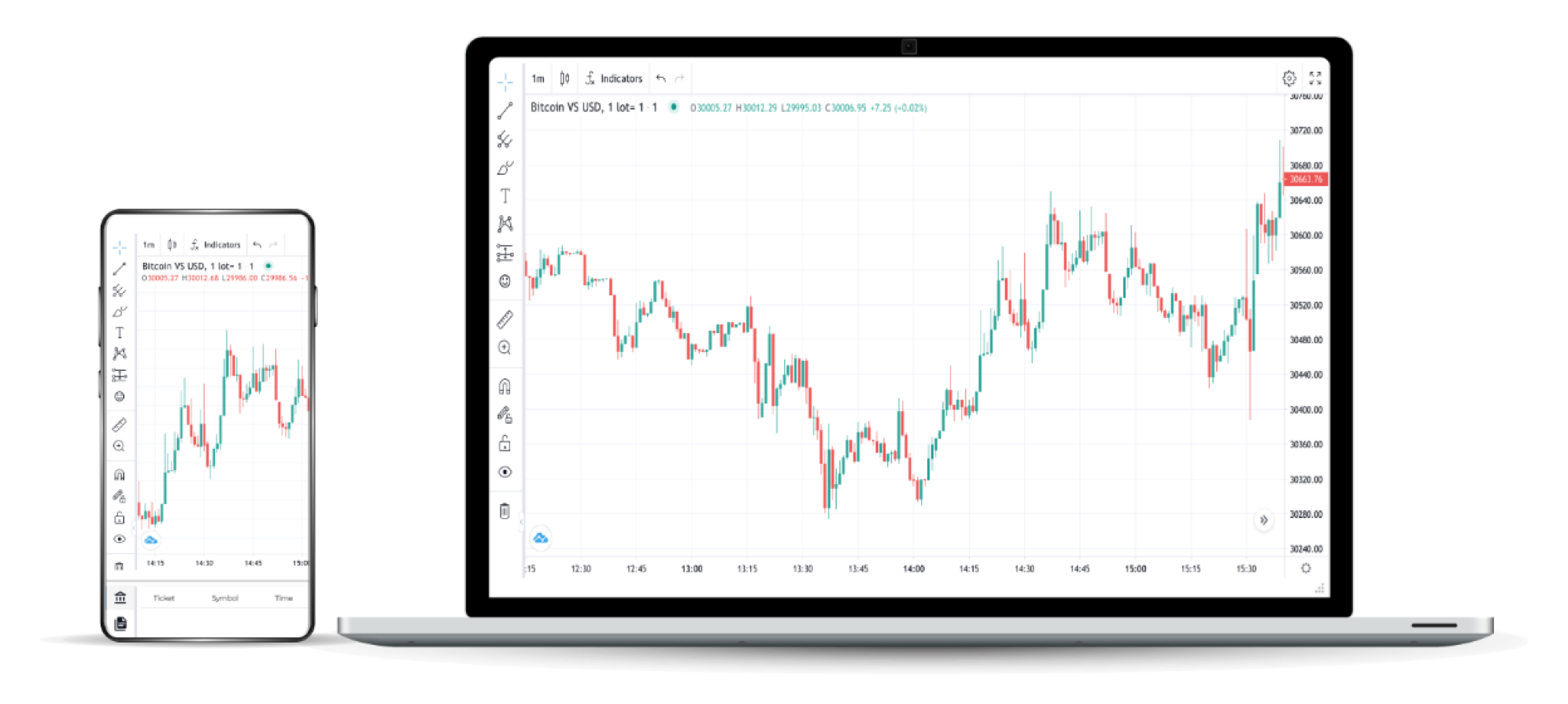

Consider leveraging Blazepeak Reaction Finance for your investment management strategy. This platform combines advanced analytics with user-friendly tools, helping you maximize returns with precision. Utilize their intuitive interface to track market trends in real-time and make informed decisions that align with your financial goals.

By focusing on smart investment techniques, Blazepeak enables you to diversify your portfolio effectively. The tool offers insights into various asset classes, allowing you to adjust your investments based on performance metrics and macroeconomic indicators. Take advantage of automated alerts that keep you updated on market shifts, ensuring you never miss a key opportunity.

Incorporate data-driven strategies into your investment approach with Blazepeak. With robust algorithms analyzing historical data, you receive tailored recommendations that refine your investment choices. Collaborate with a community of like-minded investors to share insights, fostering an environment of knowledge and growth.

Utilizing Algorithmic Strategies for Optimized Portfolio Allocation

Implement a multi-factor model to guide asset selection. This approach utilizes various financial indicators, including valuation ratios, momentum, and volatility, to identify stocks with strong potential. Analyze historical data to determine which factors have yielded the best performance over time.

Incorporate machine learning techniques to enhance decision-making processes. Train algorithms on past market data to recognize patterns that inform future trades. Regularly re-evaluate the models to adjust for changing market dynamics.

Utilize optimization algorithms, such as Mean-Variance Optimization or Black-Litterman, to fine-tune portfolio weights. Assess the risk-return profile of each asset, ensuring alignment with specific investment goals and risk tolerance. This mathematical approach can significantly enhance the balance between risk and reward.

Employ risk management tools, including stop-loss orders and diversification strategies. Set limits to minimize losses while maintaining exposure to high-performing assets. Diversifying across different asset classes reduces the overall risk of the portfolio.

Regularly backtest strategies against historical data to gauge their performance before implementation. This helps in identifying potential weaknesses and making necessary adjustments, ensuring robustness in real-world scenarios.

Adopt real-time monitoring systems to analyze market conditions swiftly. Automated alerts can notify portfolio managers of significant changes, allowing for timely adjustments to optimize performance.

Integrate sentiment analysis tools to gauge market sentiment around particular assets. By analyzing social media trends and news articles, one can gain insights into investor behavior and potential market shifts.

Ensure continuous education and adaptation of your algorithmic strategies. Stay updated on advancements in financial technology and emerging algorithms that could enhance portfolio management practices.

Assessing Risk Through Advanced Data Analytics in Investment Decisions

Utilize predictive analytics to pinpoint risks in investment strategies. By leveraging historical data, algorithms can identify patterns that reveal potential pitfalls. Tools like machine learning can analyze vast datasets, allowing for timely adjustments to portfolios based on market conditions.

Incorporate scenario analysis to evaluate various market conditions. Simulating potential outcomes helps investors understand the impact of different events, such as economic downturns or regulatory changes. This proactive approach ensures readiness for unexpected shifts.

Employ real-time data feeds to stay informed on market dynamics. Accessing live updates on stock performance, interest rates, and geopolitical events enables swift decision-making. Integrate data from diverse financial sources, enriching your analysis and enhancing accuracy.

Visualize data through dashboards to simplify complex information. Interactive charts and graphs can help identify trends and anomalies quickly. This visual clarity improves communication among team members and aids in making informed investment choices.

Collaborate with data scientists to refine your models. Expert insights can boost the accuracy of risk assessments, ensuring your strategies are backed by robust analytics. Engaging with specialists enhances your understanding of advanced methodologies.

Utilize stress testing to measure portfolio resilience. Assess how your investments perform under extreme market conditions. This technique reveals vulnerabilities and allows for strategic adjustments before crises arise.

Finally, continuously update your models with incoming data. The financial landscape shifts frequently, making ongoing analysis essential. Regularly review and calibrate your approaches to maintain accuracy in your assessments.

For more insights on smart investment management, visit https://blazepeakreaction.co/.

Q&A:

What is Blazepeak Reaction Finance?

Blazepeak Reaction Finance is a financial management platform designed to provide users with advanced tools for smart investment management. Its main goal is to help investors analyze market trends, manage their portfolios effectively, and optimize their investment strategies using data-driven insights.

How does Blazepeak Reaction Finance differ from other investment management tools?

Blazepeak Reaction Finance stands out due to its integration of real-time analytics and machine learning algorithms that provide tailored recommendations. Unlike many conventional tools, it focuses on adapting investment strategies based on current market behavior, offering users a more personalized experience in managing their finances.

What features does Blazepeak Reaction Finance offer to its users?

The platform offers a variety of features that include portfolio tracking, risk assessment tools, automated trading options, and personalized alerts. These features work together to enhance user experience and streamline investment decisions, making it easier for both novice and experienced investors to manage their assets effectively.

Can Blazepeak Reaction Finance help beginners in investing?

Yes, Blazepeak Reaction Finance is designed with both beginners and experienced investors in mind. For beginners, it provides educational resources and easy-to-understand tools that help demystify the investment process. Additionally, its user-friendly interface allows new users to start investing without feeling overwhelmed by complex financial jargon or processes.

Is my data secure with Blazepeak Reaction Finance?

Blazepeak Reaction Finance prioritizes user security and data privacy. The platform utilizes encryption protocols and advanced security measures to protect user information and financial data. Users can feel confident knowing that their personal and financial data are safeguarded against unauthorized access.

Reviews

Olivia

It’s intriguing how some platforms claim to simplify investment management while presenting convoluted strategies that sound more like cryptic slogans than actionable insights. Blazepeak seems to play into this trend with a mix of buzzwords and assurances that raise more eyebrows than confidence. One might wonder if their “smart investment management” is genuinely approachable or merely a facade for complexity dressed in sleek visuals. With so many options available, the true test will be whether they can deliver tangible results or if it’s just another addition to the long list of flashy services that fail to resonate with the average investor. Conversations about finances should be straightforward, not wrapped in jargon.

Matthew

I’m skeptical about how Blazepeak manages to blend finance with smart tech. Are we really ready to trust algorithms over human intuition? Sounds risky to me.

John

I can’t help but worry about how much I’ve been hearing about Blazepeak lately. It sounds too good to be true. Are they really managing investments smartly or just riding a wave of hype? With my hard-earned savings at stake, I need something I can trust, not just another flashy tech gimmick. What if it all goes wrong?

Kevin

Smart choices lead to wealth. Invest wisely and shape your future!